The Birthplace - one of the most expensive real estate assets in the world

The Prophet's saw Birthplace is estimated to be amongst the priciest land in the world.

Generally, discussions about assigning monetary value to religious heritage sites, or speculation about their commercial potential, tend to be criticised as being irreverent and displaying ignorance of the fact that these sites play roles for communities which are more essential than money, and hence, which cannot be replaced by any amount of compensation. Furthermore, such debates are [also] seen as carrying the hazard that they may incentivise one or more developer to attempt to purchase these sites with a view to destroying them and replacing with higher-profit generating alternatives.

Why speculate over the financial value of the Birthplace?

Knowing the widespread sentiments of believers towards their heritage, and particularly, believers towards the Birthplace, why, then, risk a public deliberation about the financial worth of the Birthplace - especially in a climate where authorities are already being lobbied by both extremists and developers to allow its destruction?

The rationale behind such an undertaking is that, in the case of the Birthplace, the exercise actually benefits the cause of saving the site by unearthing evidence that the site has been considered 'Prime Property' since the advent of Islam; this fact, then, directly refutes the key claims made by the extremists regarding the Birthplace.

The Extremists' Contention

That the site must not be accorded any significance now, and should instead be permitted to be destroyed, on the grounds that, for the past 1500 years the site has not been used or developed in any meaningful way, because:

(i) The leaders of Islamic nations, Meccan Authorities, and Clerics have attached no value to the Birthplace, and, hence, made no efforts to preserve it.

(ii) The Birthplace has been of so little interest to Meccan citizens and visitors, that none has been willing to make use of it.

The Realty

The evidence that exists about the history of the property market around the Grand Mosque and Birthplace, and the popularity of the Birthplace, supports the Sunni Muslim majority assertion, that for the vast majority of the period since the Prophet's saw demise, conditions in Mecca have been such that the birth site would have been eagerly sought-after for rent or purchase, for both residential and business uses, had it been permitted to be offered to the public.

However, first Mecca's notables, and then the state, prevented the site from being exploited for commercial gain, and instead it has been continually safeguarded, repaired, renovated and embellished throughout its history, and in a manner acutely sympathetic to its primary function as a holy site.

The Birthplace was acknowledged as an emminently sacred site due to its associations with the Prophet Muhammed saw, the Prophet Muhammed's saw family, the Prophet Abraham as, and as a historic space carrying 1500 years of interaction with countless millions of pilgrims, including visitation by the Muslim world's most celebrated personalities.

Furthermore, as real estate situated in one of the most sought after locations in the world, for both residential and business uses, the Birthplace offered another reason to be valued so highly.

The tremendous monetary value of the Birthplace site stems from its sacredness and physical proximity to the Grand Mosque in Mecca

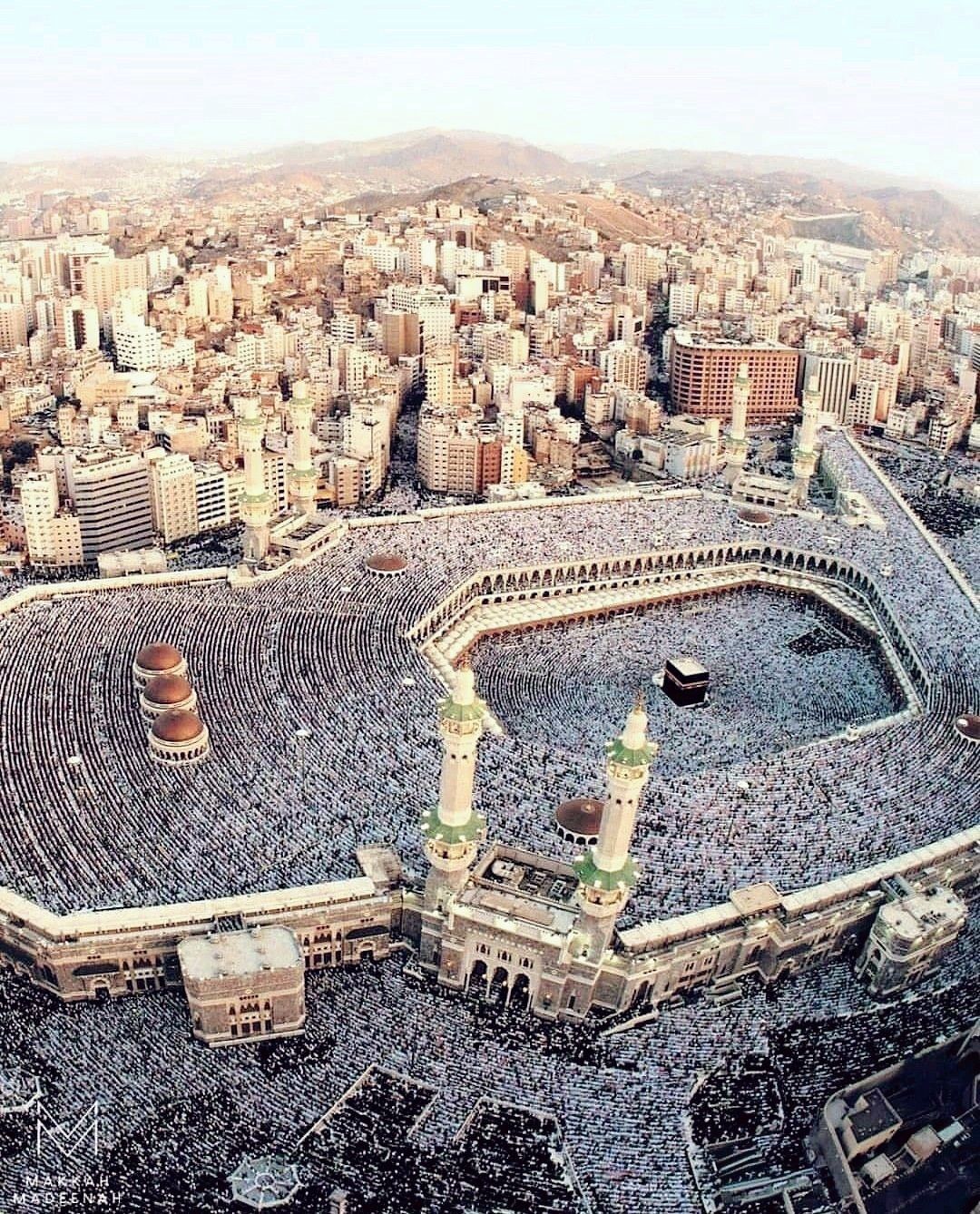

Due to its position as the focal point of Mecca, competition is keen for the area surrounding the Grand Mosque. The commercial and residential sectors have been evolving around the Mosque since the early days of the Islamic faith. By the end of the Prophet's saw tenure in 631/632 CHECK, approximately 100,000 people visited Mecca to perform the Haj pilgrimage with him saw.

Today, the millions of pilgrims that flock to the city each year generate huge demand for housing, hospitality, and retail services - particularly in the immediate vicinity of the Grand Mosque. The area is also a prime residential location for those who can afford the excessive prices and wish to live close to the Mosque in order to be able to walk to, and pray there, on a daily basis.

The competition between commercial and residential operators to gain a foothold as close to the Mosque as possible, has been further exacerbated in recent years by the growth of the resident population of Mecca, the predicted increase in numbers of pilgrims from (approximately 26.5 million in 202??) to…increase in total pilgrim numbers to around 32?? million

by 2030, and the limited supply of flat land there adaptable for development. This clamour has exerted great upwards pressure on real estate prices, resulting in some of the highest land values in the world.

Evaluating the Price of the Birthplace Site

The market value of a historic asset such as the Birthplace would be calculated by evaluating four factors:

1) Location Value. The value of the plot based on the price, per-square-meter, of/for land in that specific location.

2) Heritage Value. The premium that can be charged in addition to the Location Value to reflect the site’s historic, cultural, and religious significance.

3. The Highest and Best Use that is possible at the site.

4. Potential Buyers, and the likely maximum price they would be prepared to pay, to own or use the site.

1. Location Value

In order to understand the price structure of land in the vicinity of the Grand Mosque requires, ideally, an investigation into the reasons underpinning this structure, as well as current land costs:

(i) The Cost of Land

(ii) Why is the land close to the Grand Mosque so expensive?

(iii) State purchases of land around the Grand Mosque

(i) Cost of Land

Land Prices around the Grand Mosque

In recent years, rates for land available close to the Mosque have reached astronomical levels:

-- In 2007 the cost of a square meter of land ranged from $27,000 to $80,000 fn1;

-- In 2010 the top rate [/ for prime land] crossed the $100,000 figure. fn2;

-- Since 2013, plots have been costing between US$ 133,000 and US$ 400,000 per square meter, and the buying spree meant that by 2016, the greater proportion of the city was owned by commercial real estate developers fn4.

-- By 2018, the shortage of land for sale around the gm became so acute, that developers faced challenges finding sufficient land for new retail projects fn5.

Fn1: Middle East Economic Digest (MEED), quoted in …

Fn2: https://www.arabianbusiness.com/makkah-land-prices-hit-133-000-per-sq-metre-report-40490.html

Thu 18 Feb 2010

Fn3: http://www.arabnews.com/saudi-arabia/square-meter-land-makkah-now-costs-sr-15-million

February 09, 2013

Fn4: https://www.theguardian.com/cities/2016/sep/14/mecca-hajj-pilgrims-tourism

Guardian 14 sept 2016

Fn5: https://www.venturesonsite.com/news/makkah-faces-shortage-of-large-and-suitable-land-plots-for-malldevelopments

20th September 2018 ----- this site quoting a Tradearabia news report

Prices in Mecca are constantly being projected upward, with only short periods of price dips. The city’s prime residential property prices are already substantially higher than the next five most expensive cities to buy prime property in globally:

Costs of Prime Residential Property in Cities around the World

- The top 5 most expensive residential markets after Mecca ranked 2022

CITY COST PER SQUARE METER

Monaco US$59,000

Hong Kong US$48,000

New York US$30,000

Singapore US$29,000

London US$29,000

For further information see:

https://www.knightfrank.com/research/article/2023-03-01-where-are-the-most-expensive-cities-in-the-world

(ii) Why is the land close to the Grand Mosque so expensive?

The highest priced land in Saudi Arabia is found in the areas neighbouring Mecca’s Grand Mosque. This is due to growing demand combined with limited numbers of housing and commercial units available for sale or rent. has caused a surge in real estate values in recent years. The situation is similar with temporary accommodation: rising demand for rental units, and the lack of adequate supply, have led to substantial rent increases.

1) High Demand

Mecca has continually witnessed an extraordinary clamour [demand] from both, its citizens and visitors, to dwell close to the Grand Mosque. The key motive is to obtain 'Sawab' (reward): the earning of spiritual reward, from God, through the performance of good deeds and piety.

reasons for wanting to reside near the gm is to obtain the additional rewards of praying in the gm, and to minimise travelling time to and from the mosque for each prayer…/…ease the frequent travel to

the gm:summarised these as follows:

-- Praying in the Grand Mosque carries 100,000 more sawab than a prayer performed in any other mosque in the world. Residents of the city who wanted to perform their five daily prayers in the Grand Mosque, preferred to live close to it in order to to make their frequent visits more convenient.

--The merit for each prayer in the Mosque is increased by travelling to the Mosque on-foot. Therefore, the distance between a worshipper's residence, and the Grand Mosque, had to be sufficiently close to make walking, to and from the Mosque, feasible.

--Living near the Grand Mosque conferred prestige. People who resided in the vicinity of the Mosque were considered more pious and blessed.

--Meccans who lived in the outskirts of the city and who visited the Grand Mosque on a daily basis, were forced to trek along narrow roads in poor conditions. Many decided to relocate their homes closer to the Mosque in order to avoid the time-consuming and difficult daily journey.

--The desires of large numbers of pilgrims to have their accommodation as close as possible to the Grand Mosque prompted many landlords to obtain plots and properties near the Mosque as these would not only command higher rental rates, but also deliver high occupancy levels, and fewer void periods.

2) Shortage of house building land

The primary reason for the limited supply of land in Mecca was topographical constraints. The city is situated in a valley surrounded by steep mountains. This has meant that for most of its history, physical expansion of Mecca has been hindered and development has been confined mainly to the relatively flat areas of the city centre. The combination of the permanent housing needed for Meccan residents, and the short-term accommodation required for ever-increasing numbers of pilgrims, has resulted in a situation where Mecca has faced housing congestion and shortages since the second century of Islam.

meant that Mecca had faced housing congestion and shortages since the second century of Islam

both the indigenous and temporary populations. both resident and pilgrim populations

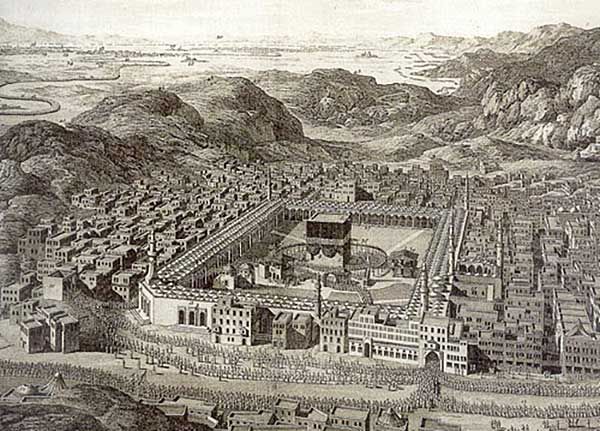

At the time of the Prophet's (saw) migration, Mecca consisted of a small nucleus of houses belonging to the elite of Mecca's tribes and encircling the Ka'aba. Most of these houses were single-storey buildings, enclosed by temporary structures of tents, dry stone shacks, and covered shelters where servants and other labourers lived and worked to serve their employers, as well as the pilgrims. Located at a distance from the houses were some scattered tents of nomads and herds of camels, sheep and goats belonging to the merchant families of Mecca. fn:1

Closeness to the Holy Mosque has always been a primary factor in the growth and development of Makkah. From the first centur of Islam, the desire to live near Al-Haram led to the settlement becaming more compact around the Kabah. The inhabitants built their houses close together in tight clusters to make maximum use of the limited flat land

Closeness to the Holy Mosque has always been a primary factor in the growth and development of Makkah. From the first centur of Islam, the desire to live near Al-Haram led to the settlement becaming more compact around the Kabah. The inhabitants built their houses close together in tight clusters to make maximum use of the limited flat land

This area developed over the past centuries to serve the specific purpose of providing both

residential and allied service areas for people wanting to live near the Haram.

Small shops filled in where possible and smaller mosques were built, scattered throughout the city.

Ibn Battutah, who visited Makkah in 725, described it as a “big city" in terms of its built up area and absolute size of its population. fn2

The intensive land use around the Grand Mosque was not without its issues: the area became experienced congestion and high population density. The economic viability of lots that were close to the Haram produced amorphous shaped plots, a symptom of maximum exploitation. Roads, public squares and other open spaces suffered in the search for building sites. The minimum allotment for the street network led to short, narrow roads and alleys. This caused difficulties for the movement of both local and pilgrim traffic.

In 1803 a European named Ali Bey visited Makkah and gave the following description:

"There is no open place or space in Mecca (Makkah) because the irregularity of the ground and the want of space would not-permit it". fn:3

In 1877 Keane visited Makkah and gave the following description :

"The whole of this valley, about one mile and a half long by one third of a mile across, is packed and crammed with buildings of all shapes and sizes, placed in no kind of order, climbing far up the steep side of the surrounding hills ..... “ fn: 4

CHECK CORRECT PAGE NUMBERS FOR ALL QUOTES

#############################################

fn1: Angawi, Sami, Makkan Architecture, Ph.D. Thesis, University of London, 1988, p. 151.

fn2: Ibn Battutah., (1958) The Travels of Ibn Battuta, Translated with revision and notes by Gibb., H. A. R..,

Cambridge P-397.

fn3: TRAVELS OF ALI BEY IN AFRICA AND ASIA. Travelled to mecca 1806-1807

Travels Of Ali Bey - Vol.2 Publication date 1816.………p96

fn4: Keane, J. F. (1881) My Journey to Medinah : Describing A Pilgrimage to Medinah, Tinsley Brothers,

London, p. 27.

CHECK CORRECT PAGE NUMBERS FOR ALL 3 ABOVE QUOTES

(iii) State purchases of land around the Grand Mosque

We know from accounts of state purchases of land - from both /either end of the Islamic history of mecca - that the land close to the gm has always commanded substantially higher high values than other parts of Mecca.

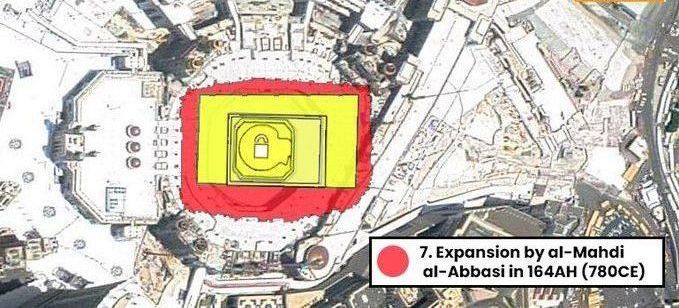

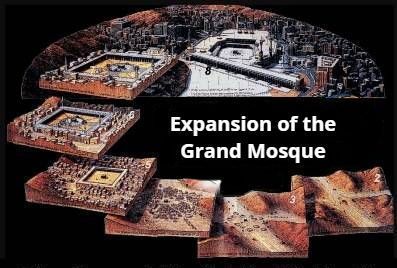

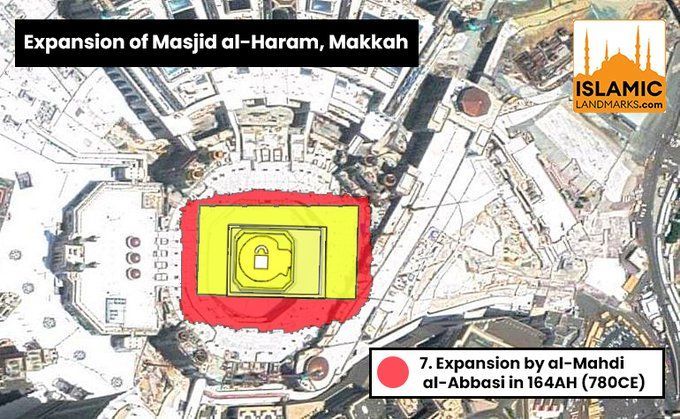

1) [Third] Abbasid caliph, Mohammed Al-Mahdi (775–785)?????

Al-Mahdi began out an extensive expansion of the Grand Mosque in Mecca in 161 A.H./A.D. 777 [[[ OR 783]]]; he died in 785, part way through the enlargement, and work/project was completed, by his son and successor as caliph, Musa.......... in..............

The size of the mosque was increased by 12,512 square meters.by adding approximately 15,000 square metres to the mosque. ..... by purchasing demolishing a substantial number of properties.

Owners of land and property within the area of the Mosque were compensated at the rate of approximately one hundred gold pieces (dinars) per square meter (25 dinars/ square cubit); whilst those with land and property at a distance from the Mosque, in the wadi (valley) area, were paid sixty gold pieces for per square metre (15 dinars/ square cubit) fn17.

These payouts were considered enormous [huge sums] at the time, and were deemed necessary to reflect, not only the market value of the land, but also the additional compensation due for the loss of the prized nearness to the Mosque. For some owners, the market price alone would alone would not have been sufficient to convince them to sell, in a climate when other land in the area was almost impossible to acquire, and the only realistic option of relocating would have been at the periphery of the settlement.

Similarly, the expansion of the Grand Mosque that commenced in 2010, also necessitated the state paying record sums to landowners to make way for the project.

FN17. Al-Azraqi, Akhbar Makkah, 1398/1978, vol. II, p. 74.

A general court was appointed to adjudicate on the compensation rate for each individual piece of the real estate - which generally consisted of land, buildings, or remains. Value estimations was conducted according to a set mechanism that took into account factors such as location, proximity to the Grand Mosque, and whether the land was mountainous or flat. In each case, the judge issued a ruling with a payout-percentage that ranged from between 25 to 75 percent.

In total, the Saudi government disbursed USD 35.5 billion to the owners of the expropriated properties. Fn1 The payouts/valuations ranged from between USD 120,000 (SR 450,000) and USD 160,000 (SR 600,000) per square metre. Fn2.

The highest rate of compensation was paid for properties such as an apartment building in the Ajyad province opposite Al-Safwah Tower, at USD 160,000 per square meter, followed by a neighbouring building with a value of USD 146,685 (SR 550,000) per square meter. The Al-Zawawi building in Al-Bab, and other structures located near to the Al-Masfalah province, reached USD 120,000 (SR 450,000) per square meter.Fn3.

Fn1: King Salman launches five projects at Grand Mosque in Mecca

https://www.thenationalnews.com/business/property/king-salman-launches-five-projects-at-grand-mosque-in-mecca-1.612283 Jul 21, 2017

Fn2. The Average exchange rate for the Saudi Riyal (SAR) to US Dollar (USD) in 2010 was 0.2667 USD. See www.exchangerates.org.uk.

Fn3: Compensation for demolished buildings around Haram

https://www.arabnews.com/node/462407/amp 25 August 2013

One of the features of Mecca’s property market that continues to be exhibited today is the high degree of differentiation in values. To some extent it may be said that the Grand Mosque performs the primary function of the city, and the rest of the city supports it through the provision secondary visitor and pilgrim services. The preeminence of the Mosque in Mecca results in land values, as well as housing costs, declining with increasing distance from the Mosque. No other site has existed in Mecca, in the past 1500 years, that has altered this equation and provided a reason for land prices to ascend away from the Mosque. Al-mahd’s purchases demonstrate that the same phenomenon was evident in 171ah: the 40% differential in the cost of the land on the periphery of the mosque and in the Wadi area, highlights the sharp variations in the mean value of properties between streets and areas.

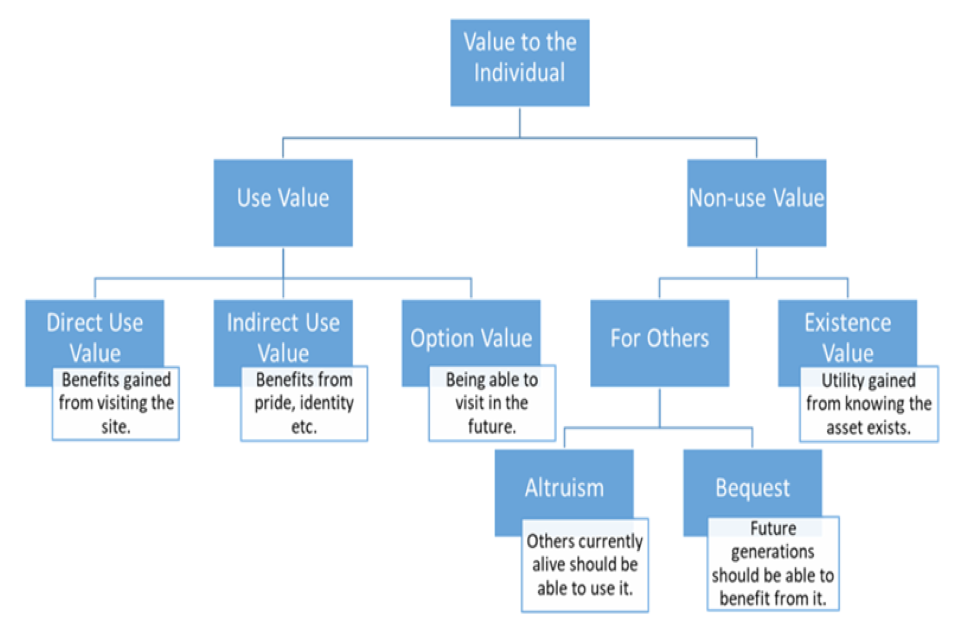

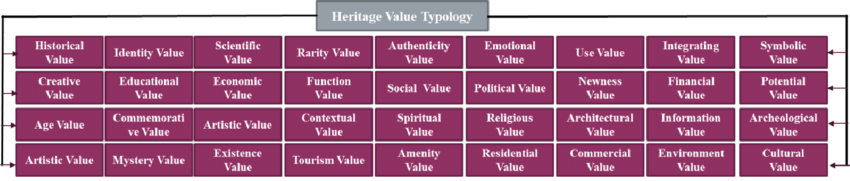

2. Heritage Premium

(i) The Valuation of Heritage

(ii) Layers of Value

(iii) Monetising Value

(i) The Valuation of Heritage

The valuation of buildings is based on the the concept of ‘market value’, which is the value that a building may be expected to achieve after reasonable exposure in a free, stable market.

Non-heritage properties are commonly valued by the Comparison method of valuation - this involves assessing the prices achieved for similar buildings already sold (the study properties) in the market, and applying these to the building being valued [to be appraised] (the subject property), whilst making allowances for the differences between the two sites. Valuations tend to be relatively straightforward as there is usually sufficient trading activity to provide comparable evidence and a price range within which to position the subject property.

The Comparison method is effective where: (i) there is evidence of the prices achieved for one or more other properties of the same general type; (ii) there are a number of comparables in the study properties which are similar or identical to the property being valued, and (iii) the transactions are recent and representative of the market at the time of the valuation,

However, heritage buildings, present a unique challenge to valuers in that:

(i) Lack of comparable evidence

Few heritage properties are sold in the open market. This often results in there being little or no transactional data to compare one historic site with another, thereby rendering the use of the Comparison method, or other conventional techniques, inappropriate or impossible in many instances.

(ii) Heterogeneity

Even where there is data on the valuations of similar heritage sites, a high degree of similarity is required between the study site and the site to be valued, in order to provide an accurate economic value of the study site. However, site characteristics are usually considerably different between heritage sites. Any given heritage property is likely to display distinctive features that are unmatched elsewhere, be they in terms of physical characteristics (e.g. an exemplar of a certain architectural style) or in terms of historical association (e.g. the site of an important historical event.

Heritage assets tend to be heterogeneous – they are complex combinations of characteristics and the economic values associated with the heritage assets are likely to be highly site-specific. This make comparisons difficult and subject to considerable error.

(iii) Heritage Premium

Unlike a modern building, the total value of a heritage asset is made up not only of its economic value, but also includes other attributes which have a bearing on its overall value: such as possessing social value and cultural value. Indeed, heritage assets can be said to have a second economic value, in addition to their physical and use value, which is the monetary value of the wellbeing and fufillment that individuals obtain from those assets. The amount by which these attributes/ additional values combined increase the selling price of the site is often referred to as the Heritage Premium.

(ii) Layers of Value

In order to measure the value of a heritage asset, a ‘non-standard’ treatment needs to be applied, one which takes into account other notions of value besides economic value. In valuers' parlance, heritage assets generate both economic value and cultural value, and, therefore, whereas for a non-heritage building, an assessment of economic costs and benefits would be regarded as sufficient for an appraisal, for a heritage site, an evaluation of net benefit streams in both economic and cultural terms will be required.

This is an advance on the traditional approach to safeguarding historic properties, which has operated on the basis of preserving the building rather than conserving the meanings and values associated with the building. In other words, the goal is to benefit the property and not the people who value the property. This method deprecates the importance of people, processes, and meanings in how places are valued and conserved. Thus, conservation professionals produce “objective” meanings for other conservators, but not for everyday people. The net result is a failure to understand how local populations actually value their historic places. Key heritage preservation decisions are often made without taking into account the personal, emotional, intangible, subjective, and perhaps spiritual value of heritage to individuals. This is despite calls from United Nations Educational, Scientific and Cultural Organization (UNESCO) to recognise the human value of heritage. UNESCO (2009) advocates,

“Heritage is our legacy from the past, what we live with today, and what we pass on to future generations. Our cultural and natural heritage are both irreplaceable sources of life and inspiration”.

Hence, In order to arrive at the most accurate valuation of a heritage asset, the valuer needs to consider the empirical economic data on the asset in tandem with the full spectrum of cultural and religious values associated with the asset. These "Values" may be described as the Intrinsic value and the Instrumental value of the asset.

Intrinsic value is the individual intellectual, emotional and spiritual experience of the heritage. It is also the value inherent in heritage, the benefit derived from heritage products for their existence value and for their own sake; historical, aesthetic, social or scientific and the value of an asset through fundamental analysis without reference to its market value. Another facet of the intrinsic value of heritage buildings is that they are evidence of human achievement in arts, design and construction.

The Venice Charter (1964) establishes the inherent values of heritage, and the relationship between these values and the fabric of the structure: "A monument is inseparable from the history to which it bears witness and from the setting in which it occurs". (Article 7). The Charter further emphasises that these values should be revealed so that the site's meaning can be ‘read’: "Every means must be taken to facilitate the understanding of the monument and to reveal it without ever distorting its meaning". (Article 15, ICOMOS, [1964] 1996.

FN1: The Venice Charter is the common term given to The International Charter for the Conservation and Restoration of Monuments and Sites (ICOMOS) [1964].

Instrumental value is the ancillary economic effects or other benefits which may derive from the heritage asset. These include visitors and volunteers, as well as wider social, financial, environmental, and educational benefits at a community or greater level.

The Birthplace possesses a multiplicity of "values" which influence its market valuation because they are held as highly significant for pilgrims and other visitors, for residents and businesses, for the Saudi government, for the Saudi nation, and for the Islamic world as a whole. These include:

Symbolic Value

National leaders throughout history have understood the meaning of buildings. Buildings were much more than a place to live, work, worship, or to shop. Nearly as important as these basic functions, buildings were also symbols.

Religious authorities understood that a glorious house of worship provides worshipers with feelings of awe, reverence and closeness with the deity. The Meccan scene with the Grand mosque, housing the Kaaba - the birthplace of human communal worship - and the Bp ......................is, for Muslims, symbolic of the relationship between God and the Prophet saw. The Grandeur of the Mosque, the largest place of worship on Earth, encourages visitors to view God as He should be viewed, as the Almighty, the Greatest Being. In contrast, the adjacent Bp, with its inconsequential size and non-descript appearance, encourages visitors to view the Prophet saw as He saw should be viewed, as the exemplar human being who lived a life of moderation in which the recognition of the greatness of God, and complete obedience to God, were central, while personal whims and desires were secondary. This ‘master and servant’ relationship is discernibly expressed through these two adjoining sites.

Spiritual Value

Religious heritage buildings can hold deep ‘spiritual’ qualities for individuals. Such sites become an experiential metaphysical [t‘spiritual’] space filled with emotion, mindfulness, engagement and personal meaning. Individuals use heritage buildings to revisit in their minds certain periods of their own national history, and to connect more deeply with their culture or nationhood, past life experiences, and friends and families. For pilgrims, and other visitors of a spiritual "bent," the experience of a historic religious building is more personally significant and transforming than a tourist's "gaze‟ of that building.

Irreplaceability Value

As with other heritage assets, the Bp is irreplaceable in the sense that, once lost, the original cannot be recreated. A replica can be made, but no amount of accuracy in this imitation will compensate for the fact the replica is simply a modern structure devoid of every one of the criteria necessary for a site to be categorised as heritage: no substantial age, no grounds to confer cultural or religious significance on it, and no public reverence of it on the basis of the site it replaces. In the case of the Bp, a replica could not provide the public that which the BP is able to: 1500 years of interaction with the Muslim world, the sacred residency of a Divine emissary, visitation by millions of humans during the sacred pilgrimage, and the reverence, as the fourth holiest site in Islam, of hundreds of millions people around the world.

In order to bring history back to life, a few countries have created ‘copies’ and replicas of general historic sites, such as replica Norman forts and Saxon villages, as an educational or visual experience, but none has deliberately destroyed a historic site in order to make way for its replica, nor attempted to ascribe to the replica, the experience or significance of the original site.

Irreplaceability makes the economic valuation of heritage assets a tremendous challenge. The degree of irreplaceability is more acute for heritage assets which are also classed as National Treasures, such as the Bp. National Treasures are widely believed to be incapable of economic valuation.

Rarity Value

How unique the heritage asset is as an example of its type, can have a substantial impact on its market value. Many heritage sites are one-offs, or the only one remaining of their kind, and this exclusivity generates interest as rarity adds value.

Broadness of Support Value

The scale on which the asset matters will give some indication of whether, and how far in excess of its market value [price], the site is likely to be valued by its supporters. The geographical range on which the site matters to the public, policy makers, and other stakeholders may be on a regional, national or international level. It may also include international or national commitments such as a UNESCO listing/recognition or conservation protection under national planning policies.

Locational Connectivity Value

Certain heritage assets derive part of their overall value from their surroundings. Whereas some high profile heritage sites dominate their locations and positively impact the values of surrounding properties, others experience an enhancement in their value due to particular features in their setting, for example, they are situated in a major or capital city, ANOTHER REASON, they are in the vicinity of a heritage site of still greater significance. The latter case applies to the Bp: it is in the vicinity of the Grand Mosque, the holiest site in Islam, and thereby, its inherent colossal value is further embellished through its proximity to the Mosque, and its connections to the Mosque in terms of age and shared history.

Provenance Value

The provenance of an heritage asset will often significantly enhance value due to association with a particular former owner(s). The Bp was built, owned, and lived in by the Prophet’s saw family and relatives who were all direct descendants of Prophet Abraham: the house was built by the Prophet’s saw grandfather…. The ownership was subsequently transferred on to the Prophet’s saw father……, and was lived in by the Prophet saw and His saw parents. The ownership was later passed onto the Prophet saw, Himself saw.

Priceless Value

The unique nature of some heritage assets means that they are considered 'priceless'. It is not that they cannot be priced, but rather a consensus exists that any price arrived at will not be a true reflection of the site’s unique contribution to overall cultural wealth – because such a market value will fail to recognise worth as opposed to value. Where the asset is deemed to have high 'worth' , but cannot yield a market value using conventional methodology, then it is normally decided that it is not practical to value the asset on the balance sheet...This situation is most likely to arise in relation to assets which could be considered to be National Treasures.

Prestige Value

The international landmark status of the Bp confers prestige and attraction on the surrounding area. Residents and business owners derive an amenity benefit from the site and this is reflected in the value of their properties. The element of the price of these properties that is due to the heritage site, represents a type of indirect heritage premium for non-heritage properties located in the vicinity of a heritage site.

Economic Value

Sites such as the Bp, are major attractions which deliver economic value to the area surrounding them, through the expenditures by visitors on sectors such as hospitality (accommodation landlords and hotels), food outlets, multiple types of retailers, and transport. These sites also benefit the vicinity by attracting investment from local or national government in order to maintain or enhance the revenue generated by the presence of the site, for example, by improvements to local roads and pedestrian walkways.

In addition to the preceding values, which are widely acknowledged features of heritage assets, there are other, perhaps more subtle, characteristics of such sites, in terms of the feelings and attitudes they foster amongst both professionals and the public. These factors also contribute significantly to elevating the value of a site.

Pride Value

For Muslims around the world to know that, in contrast to the situation regarding the birth sites of most historic figures, they enjoy the rare privilege of possessing the birth site of their founder.

Altruistic Value

This value is derived from the knowledge that others may enjoy the historic environment.

Bequest Value

This value is derived from the desire to conserve heritage assets for future generations.

Existence value

This refers to the benefits that arise from the knowledge that our heritage is being conserved per se.

Non-Use Value

Apart from residents and visitors, the general public of the region or nation, or even the international community, may have a desire to protect a site, and be willing to contribute towards the conservation of a heritage asset, regardless of the fact that they may not visit it or be near it . This form of value is known as Non-Use Value (NUV) or passive use value. One of the mains reasons why it arises is that many people feel the influence of the past and they see themselves as stewards of the nation’s heritage.

(iii) Monetising Value

Valuers face a challenge in judging how values, such as cultural or religious values, manifest in the price assessment of a site. As an intangible factor, the effects of a particular "value" are difficult to quantify. Since there are no industry standards, weighting the impact of values in monetary terms is heavily reliant on subjective interpretation.

Another aspect of valuations is that real market value is not the same as the value to the owner or the purchaser - who may be affected by feelings such as, sentimentality, the desire to own in order to receive public acclaim, or a belief that purchasing the site to ensure its preservation is a religious duty. This can mean that a heritage site can

possess a value which far outstrips any figure which is

rational in financial analysis terms, irregardless of the

method of valuation adopted. For example, a property, which has a decaying fabric may attract buyers drawn to its aesthetic and historic interest features and who are in a financial position such that their decision-making is not dictated by consideration of costs. For them, the market value of the asset is not an appropriate measure of its perceived cultural or educational worth, which cannot be measured in financial terms. In such cases, the value of a particular site boils down to its worth to the prospective owner. Similarly, with premier heritage sites such as the Bp, the value of the site is what it is worth to the Saudi nation and to the world's 2 billion other Muslims.

3. Highest and Best Use

In order to make a well-founded investment decision, a prospective buyer of real estate must ascertain, prior to purchase, the full implications of the projects being considered at the site: profitability, the legal position, budget, time line, etc.

In order to make a well-founded investment decision, a prospective buyer of real estate must ascertain, prior to purchase, the full implications of the projects being considered at the site: profitability, the legal position, budget, time line, etc.

Amongst the methods used to undertake such fact-finding is the "highest and best use" (HBU) analysis. This study requires a valuer to consider not only the current use of the property, but also the potential value associated with alternative uses. The valuer will then narrow down [reduce] the alternatives to one highest and best use of the property.

This HBU analysis involves assessing whether the proposed uses are:

-Legally Permissible. What potential uses of the site are, for example, offices, retail, or residential, are legally permitted? This entails a consideration of zoning laws, building codes, and government regulations.

-Physically Possible. The features of the site, such as it's size, shape, topography, soil conditions, and natural environment will affect, to some degree, what uses are suitable at the site.

In the case, of heritage buildings, the potential for structural changes, such as a new facade, re-partitioning, or expansion, may be constrained, since historic buildings generally have significant restrictions attached to them in regards to major transformations.

-Financially Feasible. This examines whether a potential use of the property can generate a sufficient return to the investor to justify the costs of purchase, development, and maintenance. The factors considered include:

--Development costs. The total outlay on the project is estimated, including build costs, fees, and finance costs.

--Profitability. If the purchaser wishes to use the site to run a business, then calculations are carried out of likely gross takings, and deductions for finance costs, capital expenditure, operating costs, and overhead expenses.

--Potential Tenants. Where a buyer intends rent the property to a commercial tenant, he will, in addition to evaluating his own expenditures on the site, need to consider the type of business that could be operated from the premises and the likely outgoings and remuneration for the tenant, in order to judge whether the site is feasible for renting to a commercial tenant.

Similarly, where the site is to be converted into residential property for rental, projections will be made of the type of tenants likely to be interested in renting the property, as well as demand, occupancy levels, and rental income.

--Maximally productive. After eliminating proposed uses that are not physically possible, legally permissible, or financially feasible, the valuer presents the proposed uses that meet these requirements and ranks them in order of highest value or return on investment.

While ranking the potential uses,the risks involved are also considered. A high reward possible use, for example, may also have a more significant risk factor than any of the other proposed uses.

From an investment perspective, the highest and best use of a property will be the use which optimizes the value and profitability of the asset and is within the investor's risk tolerance.

(ii) Potential Uses of the Birthplace Site

The bp sites has always embodied qualities that would attract a wide range of buyers: a prized location, a history that was directly relevant to local citizens and international pilgrims, a sacredness that was genuinely valued, and the immense prestige that would be conferred on whoever owned it. These elements have existed for 15 centuries of the site's existence, and consequently, had the site been made available to the general public during this period, it would have undoubtedly been of sought after for a diverse range of purposes including residential, commercial, and even light industry uses.

Similarly, today also, the site will appeal to a variety of buyers, particularly, for purposes linked to religious tourism or owner-occupier uses:

--Business operators

For a commercial enterprise, the bp represents a hugely lucrative opportunity. The current expansion of the gm will allow sa to increase Haj and Umrah visa quotas from the current ???? To ???? Pe year. With such immense volumes of pilgrims visiting the mosque next door, a substantial number would be expected - as at present - to want to visit the location of the bp. Any business operating from the site, which provided pilgrim-related products or services, could expect to convert a sizeable number of these visitors into customers. Currently, businesses such as financial services, retailers, fast-food chains, and hotels are vying for the best locations around the gm. The hospitality sector, in particular, experiences high occupancy rates from the millions of customers competing each year for the limited number of haj or umrah places available. This is allowing meccan hotels to charge some of the highest room or suite rates internationally.

--Devout muslims

For devout Muslims and Muslim organisations, the prospect of owning and residing at the site that once housed the founder of their religion, and witnessed events immensely sacred to Islamic history, would be exceptionally appealing. Worshipping in the gm each day while residing in the bp site, would be considered to be one of the ways of life/ideal lifestyle/finest lifestyles possible for a dedicated follower of the Prophet saw. Muslims of a spiritual bent would be aware that one of the surest ways to earn the priceless next-worldly rewards would be to own and preserve the bp of one God‘s Prophet‘s ams.

--Home seekers

For wealthy meccan citizens searching for a primary residence in the city, or those from outside the area seeking a second home or base close to the gm, the bp would be the ideal site. It’s location would not only give any house constructed here a high level of prominence, but also grant its owners a unique status, as well as convenient access to mecca’s most exclusive retail

district.

--Landlords ..real estate developers

Proximity to the gm has become the ultimate currency, allowing landlords with properties within walking distance to charge sky-high rents. Demand for apartment-type accommodation around the gm has always been extremely strong and delivered higher rates of return on investment than other areas of mecca. It can be expected, therefore, that demand from pilgrims for

accommodation situated on the site where the Prophet saw himself lived, will be nothing short of vphenomenal. It would also, in all probability, command Mecca’s highest apartment rental rates.

Central Government

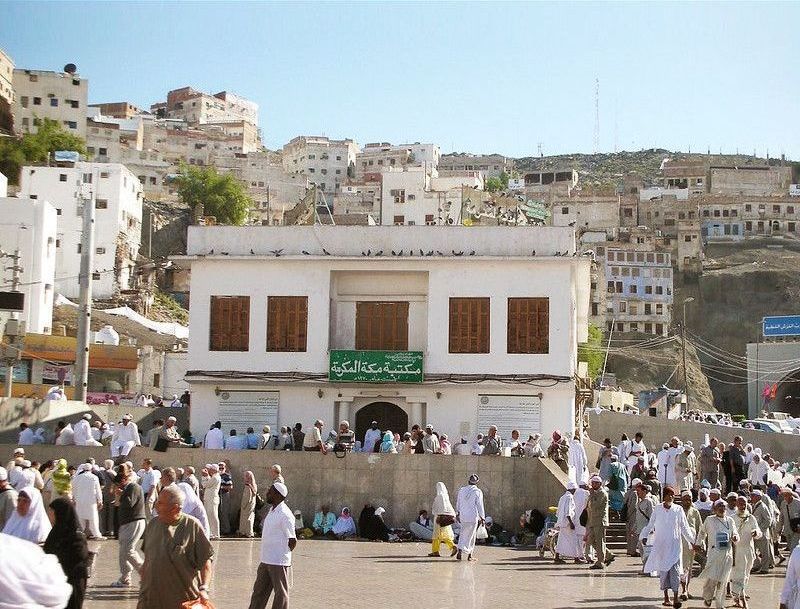

Sites such as the Bp, can appeal to Central government, local authorities, and their business space providers. They can be utilised for uses such as health services or administration - the Bp was previously used by the Saudi government to house its Haj Ministry.

However, while supporters of heritage will agree that a site may be considered to be at its highest and best use when it provides the optimum return to its owner or user, but they will, at the same time, contend that HBU can manifest not only in monetary terms, but also in intangible and social values, or a combination of such values.

For Muslims, the highest and best use of the Bp site is as it is now.

The bp sites has always encapsulated qualities that would appeal to a wide range of buyers: a sought after location, flexibility of use - for either residential or business purposes, substantial-income/profit potential, a history that was directly relevant to local citizens and international pilgrims, a sacredness that was genuinely

valued, and the immense prestige that would be conferred on whoever owned it. These elements have existed for 15 centuries. The type of buyer that would have been interested Today, the bp plot will appeal to 3 categories of buyers:

--Business operators

For a commercial enterprise, the bp represents a hugely lucrative opportunity. The current expansion of the gm will allow sa to increase Haj and Umrah visa quotas from the current ???? To ???? Pe year. With such immense volumes of pilgrims visiting the mosque next door, a substantial number would be expected - as at present - to want to visit the location of the bp. Any business operating from the site, which provided pilgrim-related products or services, could expect to convert a sizeable number of these visitors into customers. Currently, businesses such as financial services, retailers, fast-food chains, and hotels are vying for the best locations around the gm. The hospitality sector, in particular, experiences high occupancy rates from the millions of customers competing each year for the limited number of haj or umrah places available. This is allowing meccan hotels to charge some of the highest room or suite rates internationally: hotel suites with the best views are costing $7,000 per night during peak seasons. https://www.theguardian.com/artanddesign/2012/oct/23/mecca-architecture-hajj1too old quote.

--Landlords ..real estate developers

Proximity to the gm has become the ultimate currency, allowing landlords with properties within walking distance to charge sky-high rents. Demand for apartment-type accommodation around the gm has always been extremely strong and delivered higher rates of return on investment than other areas of mecca. It can be expected, therefore, that demand from pilgrims for

accommodation situated on the site where the Prophet saw himself lived, will be nothing short of

vphenomenal. It would also, in all probability, command Mecca’s highest apartment rental rates.

--Home seekers

For wealthy meccan citizens searching for a primary residence in the city, or those from outside the area seeking a second home or base close to the gm, the bp would be the ideal site. It’s location would not only give any house constructed here a high level of prominence, but also grant its owners a unique status, as well as convenient access to mecca’s most exclusive retail

district.

--Devout muslims

For devout Muslims and Muslim organisations, the prospect of owning and residing at the site that once housed the founder of their religion, and witnessed events immensely sacred to Islamic history, would be exceptionally appealing. Worshipping in the gm each day while residing in the bp site, would be considered to be one of the ways of life/ideal lifestyle/finest lifestyles possible for a dedicated follower of the Prophet saw. Muslims of a spiritual bent would be aware that one of the surest ways to earn the priceless next-worldly rewards would be to own and preserve the bp of one God‘s Prophet‘s ams.

Central Government

Sites such as the Bp, can appeal to Central government, local authorities, and their business space providers. They can be utilised for uses such as health services or administration - the Bp was previously used by the Saudi government to house its Haj Ministry.

However, while supporters of heritage will agree that a site may be considered to be at its highest and best use when it provides the optimum return to its owner or user, but they will, at the same time, contend that HBU can manifest not only in monetary terms, but also in intangible and social values, or a combination of such values.

For Muslims, the highest and best use of the Bp site is as it is now.

History refutes the extremist's claim

This article serves to demonstrate that the extremist claim:

that throughout its history, the Bp was not made use of by citizens or visitors to Mecca, for either domestic or commercial purposes, because despite being the Prophet's saw Bp, it held no value for Muslims, and therefore, it should not hold value now for Muslims, and therefore, no grounds exist to prohibit its destruction,

is patently false.

The reason why the Bp was never acquired or developed by the general public or commercial sector, was because unlike the rest of Mecca, at no time was it ever offered to them.

The records of Mecca's ancient heritage have shown that heritage buildings in Mecca, that were not protected by state safeguarding measures, were forgotten, destroyed, and built-upon within decades or centuries of coming into prominence. In the case of the Birthplace, however, the state categorised and promoted it as a premier holy site, early in its history, so that its presence and sacred character would remain intact perpetually.

The authorities held the possession of the Birthplace itself for almost one and a half millennia, for the very same reasons that it retained ownership of other holy sites, in order to ensure that all times:

(i) The site was appropriately preserved for the Muslim world. Keeping control of the site allowed the state to ensure that the site received both the funds and stewardship that it deserved, particularly, in relation to maintenance, restoration and embellishments.

(ii) It was accorded the appropriate respect towards its sacredness. Any alterations to the form and nature of the site, which would diminish it's stature, were prohibited.

(iii) It was freely available for visitation [for interaction] by pilgrims and residents of Mecca, as well by notables and royalty from around the Muslim world.

major international hotel chains, fast-food outlets , and retailers

The significance attached to the Birthplace is based primarily on the sacredness believed by the Muslim world to be inherent in the site, and the high profit-earning potential of the asset from visitation to it by local and international visitors, as perceived by the commercial sector. The reason for illustrating the real estate dynamics around the Grand Mosque, the diverse range of possible uses of, and buyers for, the BP site, as well as the probable record-breaking market price that it should command today, is not only to highlight the capabilities of the site today, but to demonstrate that these capabilities are a not a new phenomenon. These qualities have existed from the first century of Islam, and consequently the demand for the acquisition of the site, from various quarters, has also existed since that era.

The basic structure [dynamics] of land prices in Mecca has generally not changed in the past 1500 years: sites closest to the GM have always commanded the highest values in the city. The Bp has always been prized not only for being the birth site and early residence of the faith's founder, but also because it is a site situated near to the GM. The Bp's current relative value has been enhanced even further due to the expansion of the GM, which has brought the GM and Bp to become virtually, adjoining neighbours. And just as today there is a clamour from the business community and from residential property seekers for space as close as possible to the gm, so also from the advent of Islam, there was competition for the limited number of sites available around the Gm - from merchants, landlord's, and owner-occupiers.

Had the BP been permitted to be acquired by the general public or business interests, at any point in its history, it is certain that it would have been bought and exploited for financial gain, just as has been the experience of every site surrounding the Bp.

It was never offered to the public because the state, the Ulema (clergy), and Muslim public unanimously categorised the Birthplace as a immensely sacred/holy site, that was to be revered and preserved, intact, permanently.

Selling the bp

The price of land around the gm has reached a level that places the bp, along with other prime plots around the gm, as the priciest land in the world. However, with the addition of the heritage premium to the market price, means that the bp constitutes, by far and away, the most expensive land in the world today.

Despite the lofty rates, investment cartels , retail consortiums , and hotel chains are continuing to spend vast sums to gain a foothold around the gm. The lure is the near doubling of pilgrims visiting the city each year, and their spending power.

The bp sits in a neighbourhood that is not only undergoing rapid development, but setting investment records. The bp is now in the vicinity of the two most expensive buildings in the world: the Grand Mosque, which is the largest mosque in the world and also the priciest structure, costing $100 billion (£75 billion) to construct; and the Abraj Al Bait Towers hotel, which cost

$15 billion to build and is ranked as number two in the world‘s costliest buildings fn1. Coming soon is the Abraj Kudai hotel at a build price of $3.5 billion; this is expected to become the largest hotel in the world, and the seventh most expensive building in the world. To add to this tally of records, the silk and gold-embroidered cloth which is wrapped around the nearby Kaaba -

the Kiswa - is the valued as the most expensive cloth in the world, costing $8,800 per square metre. It contains 120 kilograms of gold thread and 100 kilograms of silver thread. The cost of the Kiswa is approximately $5.8 million fn2. Such distinguished neighbours can only enhance the perceived-value of the bp.

[[The new Kiswa is 658-square-meters long and is made of 670 kilograms of pure silk. For embroidery,

120 kilograms of gold thread and 100 kilograms of silver thread were used.

The cost of the Kiswa is approximately SR22 million ($5.8 million).]]

[fn1: Telegraph 27 Jul 2016]]

[fn2: http://www.arabnews.com/node/1359431/saudi-arabia August 20, 2018

It is abundantly clear that the muslim world today does not want the bp to be sold or developed in any way. However, real estate conditions in Mecca demonstrate, that if the bp were ever to be sold, it would fetch a record-breaking selling price. On the basis of its area alone, it would be worth at least ???????? Investors are aware that there is no other ancient site in the world that is

capable of delivering the calibre of investment returns that are forecast for the bp. When rare items such as historic paintings, jewellery, antiques, and classic cars can fetch eight-figure US dollar prices; and exclusive apartments and houses in the worlds leading cities reach nine-figures, then it is not inconceivable that a dedicated Muslim, a shrewd investor, or a Pilgrim-related business would be willing to spend eight, or even nine, figure US Dollar sums to acquire such a unique site.

Traditional approaches to establishing the value of heritage have centred upon economic

measuring criteria. However, this paper has illustrated that the value of heritage must be

based on more than solely economic considerations

###

REASON FOR ILLUSTRATIG THE DIVERSE RANGE OF PITENTIAL USES AND BUYERS FOR THE BP SITE TODAY, IS TO DEMOSTRATE THAT JUST AS TODAY THERE WOULD BE GREAT INTEREST FROM AROUND THE WORLD FOR PURCHASING THE SITE, SO FOR THE PAST 1500 YEARS THERE WOULD HAVE BEEN GREAT DEMAND FOR RHE SITE, DEMONSTRATE NOT LEAST, BY THE DEMAND FOR LAND ADJACENT TO, AND ALL AROUND, THE BP SITE.

Just as today sites surrounding the gm are highly sought after for a variety of purposes, there has existed high demand since the advent of Islam to obtain such sites. Had the BP been permitted to be acquired by the public, then it is certain that it would have bought and exploited for financial gain, as sites immediately around the Bp have been.

Fn1: Middle East Economic Digest (MEED), quoted in …

Fn2: https://www.arabianbusiness.com/makkah-land-prices-hit-133-000-per-sq-metre-report-40490.html

Thu 18 Feb 2010

Fn3: http://www.arabnews.com/saudi-arabia/square-meter-land-makkah-now-costs-sr-15-million

February 09, 2013

Fn4: https://www.theguardian.com/cities/2016/sep/14/mecca-hajj-pilgrims-tourism

Guardian 14 sept 2016

Fn5: https://www.venturesonsite.com/news/makkah-faces-shortage-of-large-and-suitable-land-plots-for-malldevelopments

20th September 2018 ----- this site quoting a Tradearabia news report

New Paragraph

The type of buyer that would have been interested Today, the bp plot will appeal to 3 categories of buyers:

**PROOF OF THE PROPHET SAW VALUE, PROOF OF ISLAM VALUE**

“The Grand Mosque is the place to which Muslims all over the world turn their faces when starting their prayers, so it was the focus of interest of sultans, kings, princes, leaders and even wealthy Muslim people,” said Dr. Aminah Jalal, a professor of history at Umm Al-Qura University.

“They provided all financial support for the restoration and renovation of the mosque. Religious sentiments motivated them to send donations throughout the Islamic ages, as well as providing the workers and building materials necessary to take care of this blessed mosque.

”In days gone by, leaders also ordered wells to be dug and roads paved to make the journey to the holy sites easier for pilgrims, she added, but in the Saudi era, their efforts have reached a new level

In order to make well-founded investment decisions, a prospective buyer of real estate must ascertain, prior to purchase, the full implications of the projects under consideration at the site: the legal position, budget, time line, etc.

Amongst the methods used to undertake such fact-finding is the "highest and best use" (HBU) analysis. This study requires a valuer to consider not only the current use of the property, but also the potential value associated with alternative uses. The valuer will then narrow down all of the alternatives to one highest and best use of the property.

This HBU analysis involves assessing whether the proposed uses are:

-- Legally Permissible. What potential uses of the site are, for example, offices, retail, or residential, are legally permitted? This entails a consideration of zoning laws, building codes, and government regulations.

-Physically Possible. The features of the site, such as it's size, shape, topography, soil conditions, and natural environment will affect, to some degree, what uses are suitable at the site.

In the case, of heritage buildings, the potential for structural changes, such as a new facade, re-partitioning, or expansion, may be constrained, since historic buildings generally have significant restrictions attached to them in regards to major transformations.

-Financially Feasible: This examines whether a potential use of the property can generate a sufficient return to the investor to justify the costs of purchase, development, and maintenance. The factors considered include:

--Development costs. The total outlay on the project is estimated, including build costs, fees, and finance costs.

--Profitability. If the purchaser wishes to use the site to run a business, then calculations are carried out of likely gross takings, and deductions for finance costs, capital expenditure, operating costs, and overhead expenses.

--Potential Tenants. Where a buyer intends rent the property to a commercial tenant, he will, in addition to evaluating his own expenditures on the site, need to consider the type of business that could be operated from the premises and the likely outgoings and remuneration for the tenant, in order to judge whether the site is feasible for renting to a commercial tenant.

Similarly, where the site is to be converted into residential property for rental, projections will be made of the type of tenants likely to be interested in renting the property, as well as demand, occupancy levels, and rental income.

--Maximally productive.

After eliminating proposed uses that are not physically possible, legally permissible, or financially feasible, the valuer presents the proposed uses that meet these requirements and ranks them in order of highest value or return on investment.

While ranking the potential uses,the risks involved are also considered. A high reward possible use, for example, may also have a more significant risk factor than any of the other proposed uses.

From an investment perspective, the highest and best use of a property will be the use which optimizes the value and profitability of the asset and is within the investor's risk tolerance.

---Modern day Buyers for the bp

The bp sites has always encapsulated qualities that would appeal to a wide range of buyers: a sought after location, flexibility of use - for either residential or business purposes, substantial-income/profit potential, a history that was directly relevant to local citizens and international pilgrims, a sacredness that was genuinely valued, and the immense prestige that would be conferred on whoever owned it. These elements have existed for 15 centuries. The type of buyer that would have been interested Today, the bp plot will appeal to 3 categories of buyers:

--Business operators

For a commercial enterprise, the bp represents a hugely lucrative opportunity. The current expansion of the gm will allow sa to increase Haj and Umrah visa quotas from the current ???? To ???? Pe year. With such immense volumes of pilgrims visiting the mosque next door, a substantial number would be expected - as at present - to want to visit the location of the bp. Any business operating from the site, which provided pilgrim-related products or services, could expect to convert a sizeable number of these visitors into customers. Currently, businesses such as financial services, retailers, fast-food chains, and hotels are vying for the best locations around the gm. The hospitality sector, in particular, experiences high occupancy rates from the millions of customers competing each year for the limited number of haj or umrah places available. This is allowing meccan hotels to charge some of the highest room or suite rates internationally: hotel suites with the best views are costing $7,000 per night during peak seasons. https://www.theguardian.com/artanddesign/2012/oct/23/mecca-architecture-hajj1too old quote.

Generally owners [[M. AROUND THE BP GM AREA]] fall into the following categories; private individuals; central government and their business space providers; local authorities; health services; managing agents and commercial property investors. T

Although property owners are diverse,

--Landlords ..real estate developers

Proximity to the gm has become the ultimate currency, allowing landlords with properties within walking distance to charge sky-high rents. Demand for apartment-type accommodation around the gm has always been extremely strong and delivered higher rates of return on investment than other areas of mecca. It can be expected, therefore, that demand from pilgrims for

accommodation situated on the site where the Prophet saw himself lived, will be nothing short of phenomenal. It would also, in all probability, command Mecca’s highest apartment rental rates.

--Home seekers

For wealthy meccan citizens searching for a primary residence in the city, or those from outside the area seeking a second home or base close to the gm, the bp would be the ideal site. It’s location would not only give any house constructed here a high level of prominence, but also grant its owners a unique status, as well as convenient access to mecca’s most exclusive retail

district.

--Devout muslims

For devout Muslims and Muslim organisations, the prospect of owning and living on the site that once housed the founder of their religion, and witnessed events immensely sacred to Islamic history, would be exceptionally appealing. Worshipping in the gm each day while residing in the bp site, would be considered to be one of the ways of life/ideal lifestyle/finest lifestyles possible for a dedicated follower of the Prophet saw. Muslims of a spiritual bent would be aware that one of the surest ways to earn the priceless next-worldly rewards would be to own and preserve the bp of one God‘s Prophet‘s ams.

However, while supporters of heritage will agree that a site may be considered to be at its highest and best use when it provides the optimum return to its owner or user, but they will, at the same time, contend that HBU can manifest not only in monetary terms, but also in intangible and social values, or a combination of such values.

For Muslims, the highest and best use of the Bp site is as it is now.

It was a mandatory step, so an investor could understand how much time and money it might take to renovate and reconvert the building, anticipating the technical difficulties that might occur, and to make an accurate and well-founded investment decision.

In order to make well-founded investment decisions, investors in real estate must ascertain, prior to purchase, the full implications of the projects under consideration at the site: the legal position, budget, time line, etc.

deem it is mandatory to investigate the costs of

Filling in the gap between the current status of the building and the proposed future projects was another important milestone in the valuation process. The construction work timeline and budget are estimated.

While ranking proposed uses, it is also helpful to consider the risk associated with the proposed use.

are evaluated to discern which would give the highest return on investment.

Utility value is as a subjective assessment of the expected return on an investment at a given risk, also the utility value an investor assigns to a given investment depends largely on the investors risk tolerance.

An area of land may be considered to be at its highest and best use when it provides the optimum return to its owner or user, which may be as measured in monetary terms, or in intangible and social values, or a combination of such values.

for most Muslims, it highest and best use is as it is now.

The most complex part was to complete the highest and best use analysis of the property, considering the perspectives of a potential investor: physical possibility of transformation, legal limitation from urbanistic point of view and economic feasibility. So, the next step was to understand the limitations of the building in terms of interventions it can support and repartitioning for future economic purposes, because a historical building generally comes with significant such limitations for future reconversion and construction.

Client requirements may ask for advice taking into account the client’s specific circumstances. For instance, in recommending how much to bid for the purchase of a site based on the construction costs that can be delivered by the client as a contractor. The residual method involves estimating the cost of a project and the new value created with an allowance for profit and contingency. The difference between value and cost represents the value of the unimproved property. However the estimation of costs and the timing of future payments can be complex.

SO THE BP POT C BE BOT AND AHACENT LAND BIUGHT FOR A 100 ROOM HOTEL..... AND IF BP SITE IN BIG DEMAND NOW , CERTAINLY IT WAS IN BIG DEMAND DURING THE PAST 1500 YEARS.

Utility value is as a subjective assessment of the expected return on an investment at a given risk, also the utility value an investor assigns to a given investment depends largely on the investors risk tolerance.

The investment method is used for valuing properties which are normally held as income producing investments.

while the assessment of development costs will also require comparison to be made with build costs, fees, finance costs and other elements in similar projects.

Estimating the income and operating expenses and errors magnified on capitalisation. It is not of use to owner occupied or special purpose properties. The cost approach – estimating depreciation particularly with regard to older buildings is difficult. Construction costs constantly change due to labour costs availability and fluctuations in the cost of materials.

Filling in the gap between the current status of the building and the proposed future projects was another important milestone in the valuation process. The construction work timeline and budget are estimated.

It was a mandatory step, so an investor could understand how much time and money it might take to renovate and reconvert the building, anticipating the technical difficulties that might occur, and to make an accurate and well-founded investment decision.

Filling in the gap between the current status of the building and the proposed future projects was another important milestone in the valuation process. The construction work timeline and budget were designed, with the valuation of the required quantities and construction costs being completed by one of the most prestigious appraisers in Romania for such estimates. And it took more than three weeks. It was a mandatory step, so an investor could understand how much time and money it might take to renovate and reconvert the building, anticipating the technical difficulties that might occur, and to make an accurate and well-founded investment decision.

REASON FOR ILLUSTRATIG THE DIVERSE RANGE OF PITENTIAL USES AND BUYERS FOR THE BP SITE TODAY, IS TO DEMOSTRATE THAT JUST AS TODAY THERE WOULD BE GREAT INTEREST FROM AROUND THE WORLD FOR PURCHASING THE SITE, SO FOR THE PAST 1500 YEARS THERE WOULD HAVE BEEN GREAT DEMAND FOR RHE SITE, DEMONSTRATE NOT LEAST, BY THE DEMAND FOR LAND ADJACENT TO, AND ALL AROUND, THE BP SITE.

whoever acquired the site would face criticism, perhaps long term, and face an international campaign to return the site back to heritage site for visitors to appreciate and revere.

asset for which there is often a limited market. --- if a muslim buys, would he wante to ive on a site of such saxredness, where some behaviours would be disliked or prohibited, where they may have to use or live in a way that they may find difficult, for examle, no shoes, as in the current livrary, no imoral behaviours... would they be will to accept the fact every day and night many pilgrims will be visting the site to pay their respects, perhaps thousands of people each week.

not only the breadth of the values attached by people and businesses to the Bp, but that these values and the wide spectrum of buyers for the site, but that the significance attached to the site is based primarily on the sacredness inherent in the site as believed by the citizens of Mecca and pilgrims from around thee world, and the profit-earning potential from visitation to such sites by local and international visitors, believed by the commercial sector. both these reasons existed .... associated with them These values have existed from the first century of Islam, and likewise the demand for the acquisition of such sites, from various quarters, has also existed since that era.

REASON FOR ILLUSTRATIG THE DIVERSE RANGE OF PITENTIAL USES AND BUYERS FOR THE BP SITE TODAY, IS TO DEMOSTRATE THAT JUST AS TODAY THERE WOULD BE GREAT INTEREST FROM AROUND THE WORLD FOR PURCHASING THE SITE, SO FOR THE PAST 1500 YEARS THERE WOULD HAVE BEEN GREAT DEMAND FOR RHE SITE, DEMONSTRATE NOT LEAST, BY THE DEMAND FOR LAND ADJACENT TO, AND ALL AROUND, THE BP SITE.

Just as today sites surrounding the gm are highly sought after for a variety of purposes, there has existed high demand since the advent of Islam to obtain such sites. Had the BP been permitted to be acquired by the public, then it is certain that it would have bought and exploited for financial gain, as sites immediately around the Bp have been.

############################################

Generally owners [[M. AROUND THE BP GM AREA]] fall into the following categories; private individuals; central government and their business space providers; local authorities; health services; managing agents and commercial property investors. T

Although property owners are diverse,

An area of land may be considered to be at its highest and best use when it provides the optimum return to its owner or user, which may be as measured in monetary terms, or in intangible and social values, or a combination of such values.

the haj ministry use the site

So, the analysis of the potential income, occupancy and exit value lead us to the conclusion that transforming the building into a luxury hotel is more feasible, with final calculations showing that this scenario would be 15% more profitable for an investor comparing with the office scenario.

A valuation is achieved by reference to the profits which a reasonable tenant could make from the occupation of the property. This involve examining the accounts to determine typical trading figures. From gross takings receipts deductions are made for operating and overhead costs, tenant’s capital and interest but excluding rent or mortgage interest payments. The result of this calculation is the “divisible balance” and represents the amount available for tenant’s share of the remuneration and landlord’s rent. This method is dependent on an interpretation the accounts to produce a reliable estimate of the market value. .... considers the criteria to be adopted by valuers when assessing market value or market rent for an individual trade related property.

whoever acquired the site would face criticism, perhaps long term, and face an international campaign to return the site back to heritage site for visitors to appreciate and revere.

asset for which there is often a limited market. --- if a muslim buys, would he wante to ive on a site of such saxredness, where some behaviours would be disliked or prohibited, where they may have to use or live in a way that they may find difficult, for examle, no shoes, as in the current livrary, no imoral behaviours... would they be will to accept the fact every day and night many pilgrims will be visting the site to pay their respects, perhaps thousands of people each week.

The profits method is used for a property whose value is derived from the trading potential of the business for which the building is purposely designed i.e. hotels and cinemas are typical examples. Comparison is used in assessing a fair maintainable level of trade

So, the analysis of the potential income, occupancy and exit value lead us to the conclusion that transforming the building into a luxury hotel is more feasible, with final calculations showing that this scenario would be 15% more profitable for an investor comparing with the office scenario. In order to accommodate an international chain affiliated luxury hotel, a building must offer at least 100 keys. Once the architects confirmed that around 150 rooms might be accommodated in the existing premises and several international operators confirmed their interested in the branding the project, our mission became easier.

The investment is,

however, significant, as can be expected for a historical building with such unique heritage like BCR Palace. But the market shows that it can absorb an offer for a hotel of this kind. Generally, buildings with a solid structure that can be preserved, but with renovations needed in all other areas in order for them to be reconverted, require an investment of about 900 euro per square meter, without considering the investment for furniture and all other specific equipment needed. An upper medium hotel adds another 10,000 - 15,000 euro per room for FF&E, while a luxury hotel can invest even double per room. Considering a potential exit value of over 250,000 euro per room, a price sustained by the transactions closed in our market or similar markets in the CEE region, the project becomes feasible. SO THE BP POT C BE BOT AND AHACENT LAND BIUGHT FOR A 100 ROOM HOTEL..... AND IF BP SITE IN BIG DEMAND NOW , CERTAINLY IT WAS IN BIG DEMAND DURING THE PAST 1500 YEARS.

Filling in the gap between the current status of the building and the proposed future projects was another important milestone in the valuation process. The construction work timeline and budget were designed, with the valuation of the required quantities and construction costs being completed by one of the most prestigious appraisers in Romania for such estimates. And it took more than three weeks. It was a mandatory step, so an investor could understand how much time and money it might take to renovate and reconvert the building, anticipating the technical difficulties that might occur, and to make an accurate and well-founded investment decision.REASON FOR ILLUSTRATIG THE DIVERSE RANGE OF PITENTIAL USES AND BUYERS FOR THE BP SITE TODAY, IS TO DEMOSTRATE THAT JUST AS TODAY THERE WOULD BE GREAT INTEREST FROM AROUND THE WORLD FOR PURCHASING THE SITE, SO FOR THE PAST 1500 YEARS THERE WOULD HAVE BEEN GREAT DEMAND FOR RHE SITE, DEMONSTRATE NOT LEAST, BY THE DEMAND FOR LAND ADJACENT TO, AND ALL AROUND, THE BP SITE.

Utility value is as a subjective assessment of the expected return on an investment at a given risk, also the utility value an investor assigns to a given investment depends largely on the investors risk tolerance.

Estimating the income and operating expenses and errors magnified on capitalisation. It is not of use to owner occupied or special purpose properties. The cost approach – estimating depreciation particularly with regard to older buildings is difficult. Construction costs constantly change due to labour costs availability and fluctuations in the cost of materials.

The investment method is used for valuing properties which are normally held as income producing investments.

while the assessment of development costs will also require comparison to be made with build costs, fees, finance costs and other elements in similar projects.

Client requirements may ask for advice taking into account the client’s specific circumstances. For instance, in recommending how much to bid for the purchase of a site based on the construction costs that can be delivered by the client as a contractor. The residual method involves estimating the cost of a project and the new value created with an allowance for profit and contingency. The difference between value and cost represents the value of the unimproved property. However the estimation of costs and the timing of future payments can be complex.

The most complex part was to complete the highest and best use analysis of the property, considering the perspectives of a potential investor: physical possibility of transformation, legal limitation from urbanistic point of view and economic feasibility. So, the next step was to understand the limitations of the building in terms of interventions it can support and repartitioning for future economic purposes, because a historical building generally comes with significant such limitations for future reconversion and construction.